How a CIFAS Marker Nearly Ruined Cindy’s Life

Imagine being a hardworking single mother, just trying to make ends meet, when the very bank you trusted suddenly brands you a fraudster. That’s exactly what happened to Cindy.

Her case is a powerful reminder of how quickly an innocent person can become trapped by the CIFAS system and how vital it is to have the right support to fight back.

The Shock: Branded as a Fraud Risk

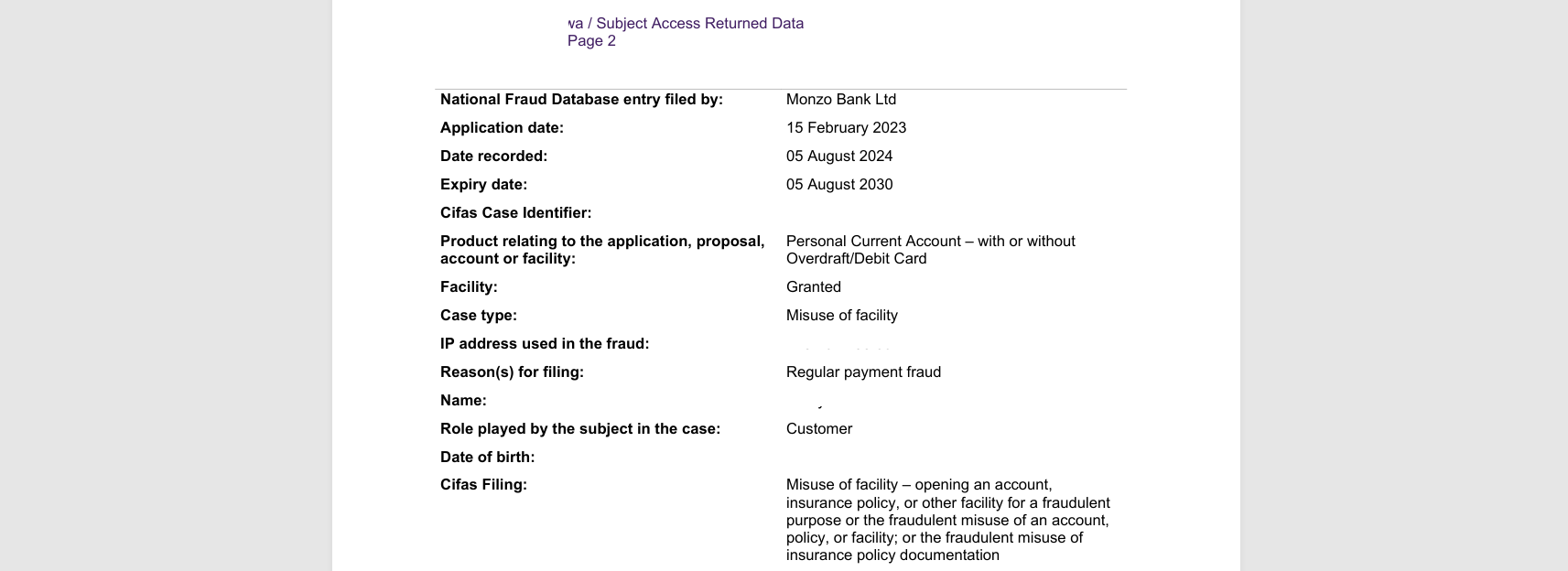

Cindy was stunned when Monzo Bank filed a CIFAS marker against her for “Misuse of Facility” and “Regular Payment Fraud.”

She had never stolen a penny in her life. What really happened was far more ordinary and tragic. Cindy’s ex-partner persuaded her to allow money to pass through her account, telling her it was for bills and the children.

When the bank questioned these payments, Cindy immediately asked her partner for proof. He had none. He fobbed her off with excuses. And before she realised the full danger, it was too late.

The Struggle: Living Under a Marker

The CIFAS marker wrecked Cindy’s life.

- She couldn’t open a bank account or pay her bills by direct debit.

- She faced humiliation and suspicion whenever she tried to access financial services.

- As a single mother, she was left unable to provide for her children properly.

- Her mental health collapsed anxiety, sleepless nights, and constant fear became her reality.

Cindy had been manipulated, taken advantage of, and left carrying the blame. Yet the bank treated her as though she had committed fraud deliberately.

The Turning Point: Fighting Back

When Cindy came to us, she was exhausted, frightened, and out of options.

Together, we built her complaint. We showed how Monzo had failed to follow CIFAS principles, which require evidence of deliberate dishonesty before a marker can be filed. We argued that:

- Naivety is not the same as fraud.

- Trusting the wrong person does not equal intent to deceive.

- Monzo had not given her a fair opportunity to respond before damaging her reputation.

We highlighted guidance from UK Finance and even referenced the Modern Slavery Act, which recognises that many money mules are victims of exploitation, not criminals.

The Breakthrough: Reclaiming Her Future

Cindy’s fight is ongoing, but her case shows something important: you are not powerless against a CIFAS marker.

Banks rely on people not knowing their rights. They expect you to accept the six-year punishment in silence. But with the right knowledge and support, you can challenge them and win.

Why This Matters for You

Cindy’s case proves three things every victim of a CIFAS marker should know:

- Markers can be challenged. They are not permanent.

- Evidence matters. Banks must prove intent, not just negligence.

- Support makes the difference. Most people give up because the process feels overwhelming. With guidance, you can flip the script.

Take Back Control

If you’re in Cindy’s position trapped under a marker you don’t deserve don’t wait six years for your life to return to normal.

👉 Book a consultation or join our next CIFAS Marker Masterclass, where we’ll show you exactly how to challenge a marker, present evidence, and hold banks accountable.

Because no one should be branded a fraudster for being naïve or manipulated.