Application Fraud CIFAS Marker

An Application Fraud CIFAS marker is recorded where a financial

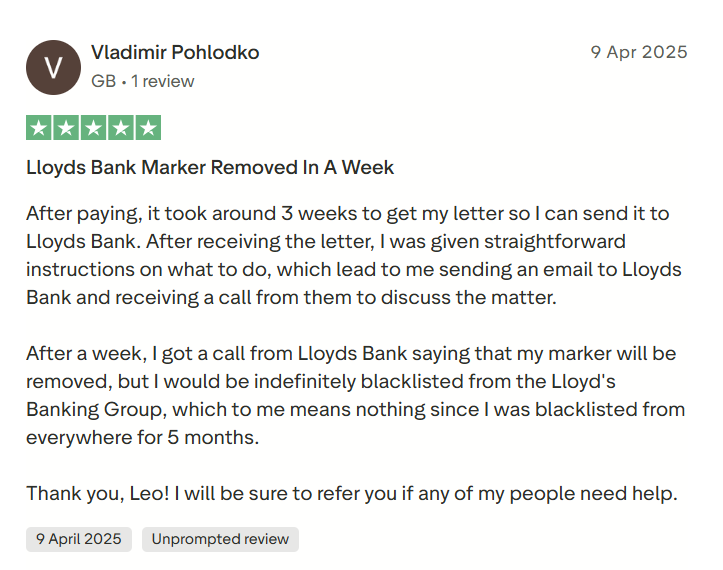

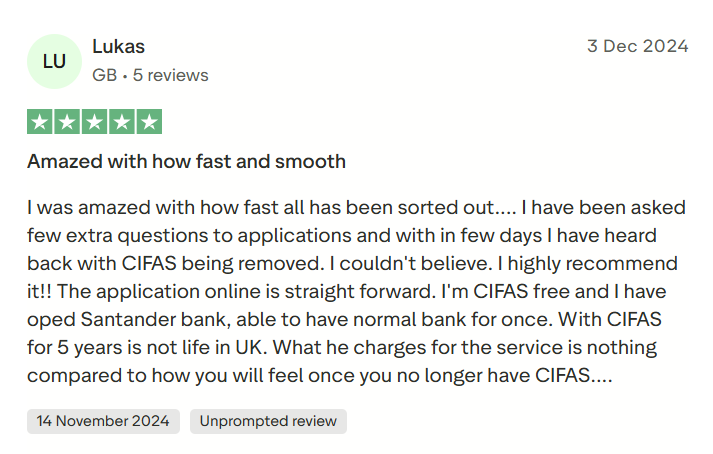

Don’t let an unfair marker freeze your financial future. We provide an advocacy service to challenge and remove unfair CIFAS markers backed by verified success stories and 5-star client reviews.

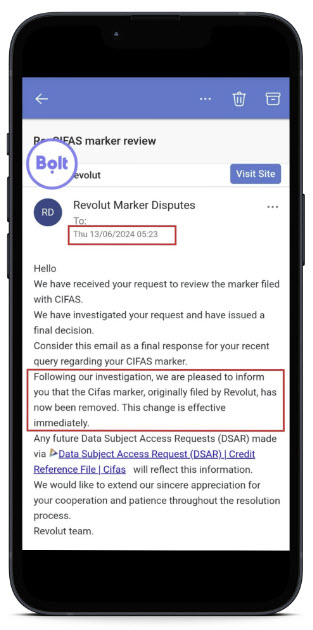

I contacted Leo to help me deal with a CIFAS marker issued by Revolut after a crypto investment had gone wrong.

He spent the first few days collecting information and discussing my situation via WhatsApp. He then prepared a very professional complaint which was submitted to revolut.

To my surprise, I received an email 3 days letter confirming that my CIFAS marker had been removed and I was extremely happy and relieved that the marker was removed so quickly.

Complete our Onboarding form to get started on your journey to get your marker removed.

Here is a simple summary on how to get started on your journey to financial freedom.

Contact us today to assess the likelihood of your marker being removed and understand your options.

Whatever your situation, we specialise in data protection and fraud marker complaints.

01

This marker is recorded where an account is alleged to have received or moved funds linked to suspected fraud.

02

False application markers relate to financial applications where information is alleged to be incorrect, incomplete, or misleading.

03

Application fraud markers are recorded where an fraudulent application is made to obtain financial services.

04

Asset conversion markers relate to allegations that funds or assets were converted in a fraudulent way.

05

First party fraud markers are applied where the account holder themselves is alleged to have committed fraud.

06

Insurance fraud markers relate to alleged misrepresentation or dishonest claims made in connection with insurance policies.

Your complaint is submitted to the issuer of the fraud marker for initial review and assessment and final response.

Your may be referred to CIFAS for review after the issuer issued a final response and refuses to uphold the complaint.

A complaint should be referred within 6 months of getting the final response for review by the Ombudsman.

If you want help challenging a CIFAS marker, you can start by submitting your details for review.

All services relate to one CIFAS marker case. If you have more than one marker, each is assessed and handled separately.

We prepare and submit complaint to issuer, you handle the full process including responding.

We manage the complaint process from start to finish, including at CIFAS & Financial Ombudsman.

Priority handling with accelerated preparation and dedicated case management.

Explore our blog for expert advice, industry insights, and latest case studies on CIFAS marker removals.

An Application Fraud CIFAS marker is recorded where a financial

An Asset Conversion CIFAS marker relates to allegations that funds

A False Application CIFAS marker relates to a financial application

A First Party Fraud CIFAS marker is applied where a

An Insurance Fraud CIFAS marker relates to alleged misrepresentation or

Misuse of Facility CIFAS Marker A Misuse of Facility CIFAS

Removing a marker means financial freedom and access to more financial services.

Quick answers to questions you have about Cifas Marker UK.

A CIFAS marker is a fraud risk record shared between organisations such as banks, insurers, and lenders. It can affect your ability to open accounts, access credit, or use financial services.

Some CIFAS markers are upheld, while others are amended or removed following a formal complaint process. Removal is not guaranteed and depends on the accuracy, proportionality, and evidence supporting the marker.

You can request a copy of your CIFAS record directly from CIFAS by making a Subject Access Request. Once you have your report, we can assess whether a complaint may be appropriate.

Timeframes vary. Some cases resolve within a few weeks, while many take several months. More complex cases, especially those requiring escalation, can take longer.

No. We do not guarantee outcomes. We provide professional support to assess, prepare, and manage complaints through the recognised process.

Not always. Many CIFAS complaints are handled through issuer complaints, CIFAS review, and the Financial Ombudsman Service. If you already have a solicitor, we can work alongside them.

If a complaint is not upheld at the first stage, it may be escalated to CIFAS and, where appropriate, to the Financial Ombudsman Service. Further options depend on the circumstances of the case.

We offer fixed fee support packages depending on the level of assistance required. Pricing is clearly explained before any work begins.

No. We are not a law firm. We provide administrative and representational support for CIFAS complaints. Where legal representation is required, we can work alongside your solicitor.