From Fear to Freedom: How Karley Beat Her Kroo CIFAS Marker

For most people, discovering a CIFAS marker is a complete shock. One day your bank is working fine, and the next your account is frozen, your applications for credit are refused, and you are treated as if you are a fraudster.

For Karley, it was one of the most stressful situations she had ever faced.

The Pain: When Victims Are Treated as Criminals

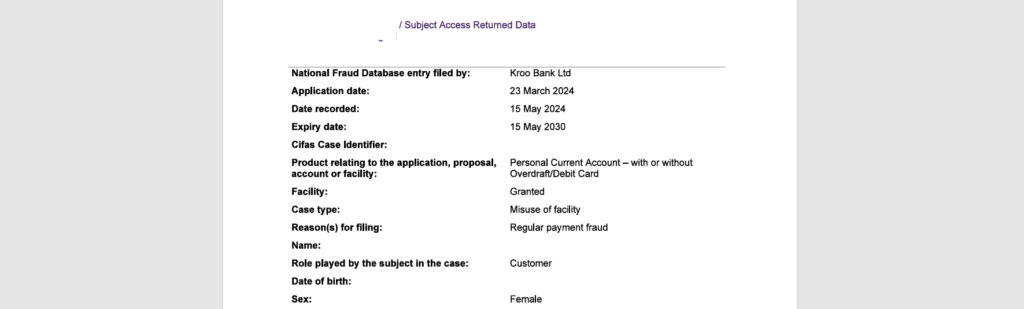

Karley had been tricked by scammers posing as an employer. Like many people searching for ways to support themselves, she thought she had found a legitimate opportunity. Instead, she was manipulated and coerced into allowing payments through her account — classic money mule tactics.

When she realised what had happened, she feared for her safety and her financial future. She turned to her bank for help. But instead of support, the bank made things worse by filing a CIFAS marker.

From that moment, her life changed overnight.

- Her bank account was blocked.

- She was rejected by other banks when she tried to open a new one.

- She faced losing her car, her job, and her independence.

- She felt constant anxiety, unable to sleep, and deeply isolated.

Karley wasn’t a criminal. She was a victim — but the system treated her like the perpetrator.

The Struggle: “No One Can Help You”

When Karley tried to get legal advice, she was told by other companies and solicitors that nothing could be done. For most people, that would be the end of the road. A CIFAS marker can last six years — six years of being branded a fraud risk.

But Karley refused to give up.

The Turning Point: Getting the Right Support

That’s when Karley reached out to us. We listened to her story and carefully reviewed her situation. It was clear that the bank had failed to follow the very rules designed to protect customers.

Together, we built a detailed, structured case. We highlighted how she had been coerced, how her vulnerabilities had been ignored, and how the bank had acted unfairly in changing their reason for the marker after the fact.

Step by step, we guided her through what was a very lengthy and complex process. The bank made things as difficult as they could, but we stood by Karley the entire way.

The Breakthrough: Marker Removed

Finally, Karley received confirmation that the CIFAS marker would be removed. The relief was overwhelming. Here’s what she had to say in her own words:

“I wish there was more than 5 stars, because 5 stars honestly isn’t enough. Discovering I had a CIFAS marker was one of the most stressful situations I have ever gone through. But Leo was there every step of the way! Other companies and solicitors told me there was no way to help me. And whilst this was a very lengthy process, and the bank made this situation as complicated as they could, I had confirmation today that it will be removed! I couldn’t have got through this without you. Thank you!”

— Karley Meadlarklan, March 2025

The Lesson: Why This Matters for You

Karley’s story is not unique. Every day, innocent people are unfairly labelled as fraud risks because banks take shortcuts, ignore evidence, or fail to recognise coercion.

But her case proves something important:

- CIFAS markers can be challenged.

- The process is complex, but not impossible.

- With the right support, you can clear your name.

Take Control of Your Future

If you’ve discovered a CIFAS marker against your name, you don’t need to suffer in silence. Whether it’s preparing a strong complaint, escalating to CIFAS or the Ombudsman, or taking the case to court if needed — there are steps you can take to fight back.

Karley’s success shows that you are not powerless. With expert guidance, you can challenge a marker, protect your financial future, and finally breathe again.

👉 Book a consultation today or join our next masterclass to see how we can help you fight back, just like we helped Karley.