CIFAS Marker Removal Service

Remove Your Pricewaterhouse Coopers Cifas Marker. Fixed Fees. Fast Results.

Specialist CIFAS removal service for Pricewaterhouse Coopers "Misuse of Facility" & Fraud markers. We provide a simple, 4-step removal process starting from just £500.

- Free Assessment

- Fixed Fees

- UK Wide

Pricewaterhouse Coopers CIFAS Marker Experts

Why Choose Us

Learn why we are better, faster and excel over traditional Cifas Marker Removal Solicitors.

- Fixed Fees: Clear packages from £500. You know the exact cost upfront.

- Specialists: We only handle Cifas marker removal. We know the Pricewaterhouse Coopers process.

- Instant Assessment: We are the only provider with an online eligibility check.

Fast Complaint Drafting

We have analysed over 1,000 cases and developed an inhouse system to prepare complaints quickly.

- Complaints can be prepared as quickly as 24 hours.

- Our complaints are often up to 20 pages long.

- We apply legal arguements to each type of marker.

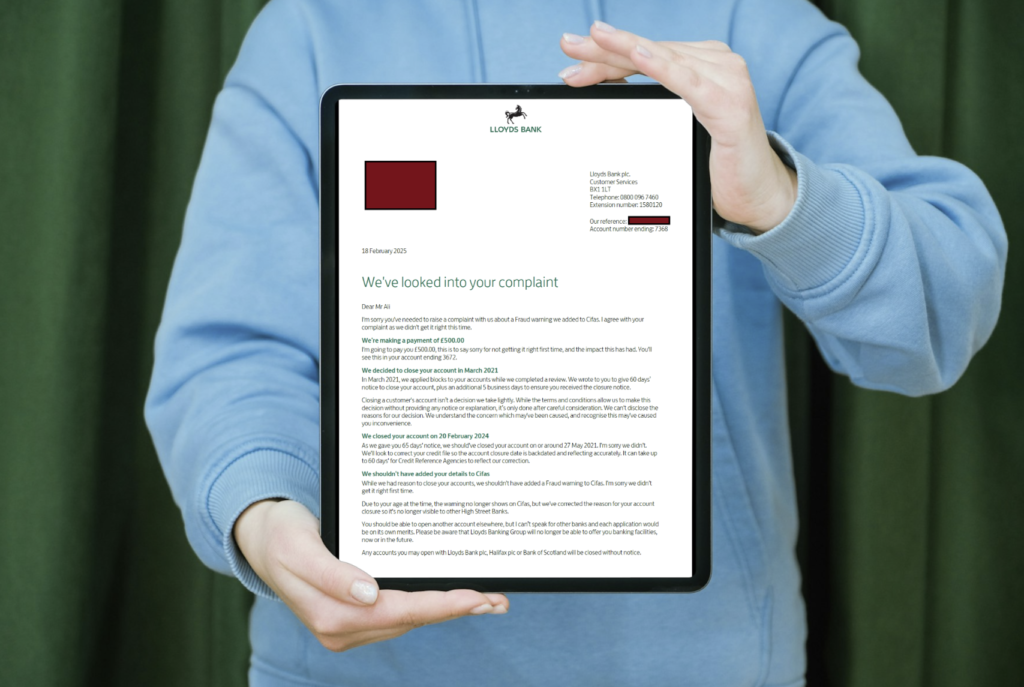

Real Cifas Removal Results

Most markers are removed between 2-3 weeks if a case has a strong chance of removal.

- 70% of cases resolved within 2-3 weeks.

- Unique contact list for the top institutions.

- Live tracking of removals

| Issued By | Reason | Removal Status |

|---|---|---|

| Bank of Scotland | Misuse of facilit - Retaining wrongful credit | Complaint Upheld |

| Barbon Insurance Group | False Application - Altered documents | Complaint Upheld |

| Barclays Bank UK | Misuse of facility - Funds received– Repeat Conduct, Conduct Unexplaine | Complaint Upheld |

| Barclays Bank UK | Misuse of Facility - Funds Received | Complaint Upheld |

| Barclays Bank UK | Misuse of facility - New Account, Credits Retained, Conduct Unexplained | Complaint Upheld |

| Barclays Bank UK | Complaint Upheld | |

| Barclays Bank UK | Misuse of facility - Funds received – Credits Retained | Complaint Upheld |

| Barclays Bank UK | Misuse of facility - Funds received– Credits Retained, Conduct Unexplained | Complaint Upheld |

| Barclays Bank UK | Falsely reporting loss | Complaint Upheld |

| Barclays Bank UK | Misuse of facility - Funds received– Credits Retained, Conduct Unexplained | Complaint Upheld |

| Barclays Bank UK | Complaint Upheld | |

| Barclays Bank UK | Misuse of facility - Funds received – Repeat Conduct | Complaint Upheld |

| Barclays Bank UK | Misuse of facility - Funds received – Credits Retained | Complaint Upheld |

| Barclays Bank UK | Misuse of facility - Funds received – Conduct Unexplained | Complaint Upheld |

| Barclays Bank UK | Misuse of Facility - Funds Received – Repeat Conduct & Conduct Unexplained | Complaint Upheld |

| Barclays Bank UK | Misuse of facility - Funds received – Conduct Unexplained | Complaint Upheld |

| Barclays Bank UK | False Application - False address | Complaint Upheld |

| Barclays Bank UK | Misuse of facility - Funds received | Complaint Upheld |

| Barclays Bank UK | Misuse of facility - Funds received – Credits Retained | Complaint Upheld |

| Barclays Bank UK | Misuse of facility - Third Party Fraud Facilitator | Complaint Upheld |

| Barclays Bank UK | Misuse of facility | Complaint Upheld |

| Capital One | Misuse of facility - Fraudulent faster payments transaction | Complaint Upheld |

| Capital One | Facility takeover fraud - Victim of impersonation | Complaint Upheld |

| Collinson Insurance services | False insurance claim - Insurance claim fraud | Complaint Upheld |

| Halifax | Misuse of facilit - Retaining wrongful credit | Complaint Upheld |

| Halifax | Misuse of facility - Funds received – Conduct Unexplained | Complaint Upheld |

| Halifax | Misuse of facility - Funds received – Conduct Unexplained | Complaint Upheld |

| Halifax | Misuse of facility - Funds received – Conduct Unexplained | Complaint Upheld |

| HSBC Bank | Misuse of facility - Retaining wrongful credit | Complaint Upheld |

| HSBC Bank | False documentation | Complaint Upheld |

| HSBC Bank | Misuse of facility: Retaining wrongful credit | Complaint Upheld |

| JP Morgan Europe | Funds received – Conduct Unexplained | Complaint Upheld |

| Kroo Bank | Misuse of facility - Regular payment fraud | Complaint Upheld |

| Kroo Bank | Misuse of facility - Regular payment fraud | Complaint Upheld |

| Lloyds Bank | Misuse of facility - Regular payment fraud | Complaint Upheld |

| Lloyds Bank | Misuse of facility - Retaining wrongful credit | Complaint Upheld |

| Lloyds Bank | Complaint Upheld | |

| Lloyds Bank | Retaining wrongful credit | Complaint Upheld |

| Metro Bank | Misuse of facility - Funds received – Conduct Unexplained | Complaint Upheld |

| Monese | Misuse of facility - Fraudulent faster payments transaction | Complaint Upheld |

| Monese | Misuse of facilit - Fraudulent faster payments transaction | Complaint Upheld |

| Monzo Bank | Misuse of facility - Regular payment fraud | Complaint Upheld |

| Monzo Bank | Complaint Upheld | |

| Monzo Bank | Misuse of facility - Funds received – Credits Retained – Conduct Unexplained | Complaint Upheld |

| Monzo Bank | Complaint Upheld | |

| Monzo Bank | Misuse of facility - Funds received – Credits Retained & Conduct Unexplained | Complaint Upheld |

| Monzo Bank | Misuse of facility - Regular payment fraud | Complaint Upheld |

| Monzo Bank | Regular payment fraud | Complaint Upheld |

| Monzo Bank | Misuse of facility - Regular payment fraud | Complaint Upheld |

| Monzo Bank | Misuse of facility - Funds received – Credits Retained and Conduct Unexplained | Complaint Upheld |

| Issued By | Reason | Removal Status |

How it works

4 Step Removal Process

We support complaints that use the simple 4 step process to get your marker removed.

Get started with a free assessment

Complete a free assessment to see how we can help and if your case is eligible.

Cifas Removal Cost

Transparent Pricing. No Hidden Legal Bills.

Fixed Price Cifas Marker Removal packages to cover the cost of handling complaints.

Documents Package

We prepare and submit complaint to issuer, you handle the full process including responding.

- We prepare complaint documents

- We submit your complaint

- Guidance on full complaint process

- Online & Email Support

Full Representation

We manage the complaint process from start to finish, including at CIFAS & Financial Ombudsman.

- We Handle All Correspondence

- CIFAS & Ombudsman Support

- Weekly Email Case Updates

- Priority Support by Email or Online

Priority & Complex

Priority handling with accelerated preparation and dedicated case management.

- 24h Document Preparation

- Dedicated Case Manager

- Priority Support by Phone

- Limited to 5 Cases/Week

mpg_partner_name Cifas Marker Removal FAQ

Quick answers to questions you may have about how to remove Pricewaterhouse Coopers Cifas Marker.

A Pricewaterhouse Coopers Cifas marker is a fraud warning placed on the National Fraud Database.

It indicates that Pricewaterhouse Coopers believes you have committed fraud or misused their banking facility. This is not a criminal record, but it is a serious marker that alerts other banks that you are a "high risk."

The most common marker issued by Pricewaterhouse Coopers is "Misuse of Facility."

This often happens if your account was used to receive fraudulent funds (even if you were tricked). Other types include "Application Fraud" (if details on an application were incorrect) and "False Application."

The impact is severe. You will likely face:

Account Closure: Cashplus will close your account immediately.

Blacklisting: You will struggle to open new bank accounts with other providers.

Credit Denial: Loans, mortgages, and car finance applications will likely be rejected.

Employment Issues: Jobs in finance, law, or security often require vetting that you may fail.

You need to file a Data Subject Access Request (DSAR).

You can do this directly with Cifas or Pricewaterhouse Coopers. This report will confirm the "Case Type" and the exact date the marker was filed.

We can assist you with interpreting this report.

Yes, if it can be proven that the marker was applied incorrectly or without sufficient evidence.

Many "Misuse of Facility" markers are applied to innocent victims of scams.

Our service challenges the bank by proving they did not meet the "Standard of Proof" required to file the marker.

Investigation: We review your DSAR and evidence.

Bank Complaint: We submit a formal legal complaint to Cashplus.

Escalation: If rejected, we escalate to Cifas directly.

Ombudsman: The final stage is a review by the Financial Ombudsman Service.

The timeline varies. Pricewaterhouse Coopers has up to 8 weeks to respond to the initial complaint. If escalated to the Ombudsman, it can take several months. We aim to get a resolution as quickly as possible by presenting a watertight case from day one.