Specialists in Student Loans Company CIFAS Marker Removal

Having a Student Loans Company CIFAS marker placed on your record is stressful. It can shut down your financial life overnight, leaving you anxious every time you apply for something.

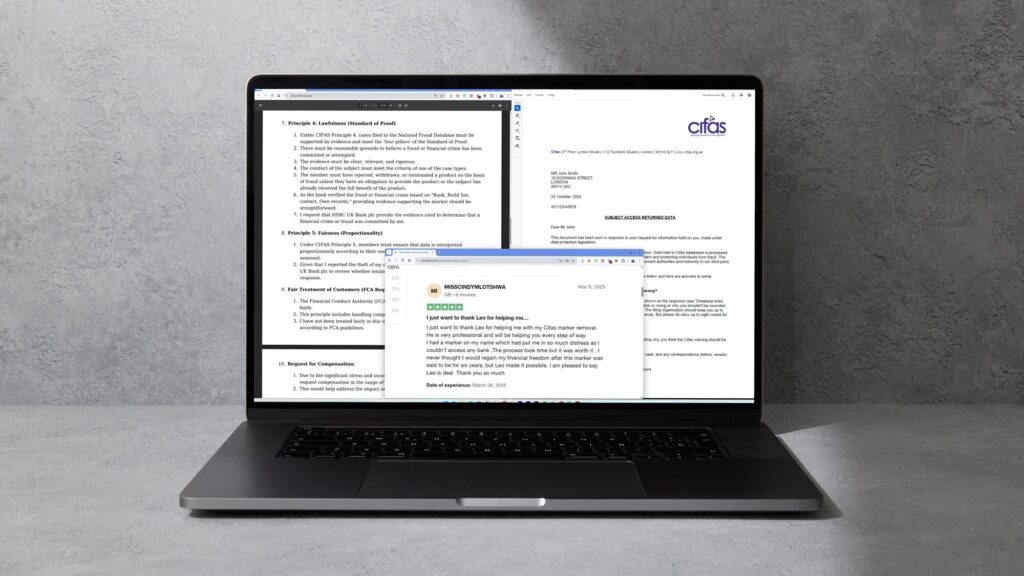

Many markers are issued unfairly, and our job is to help you challenge them through the Student Loans Company’s complaint process, the Financial Ombudsman, or if needed, the county courts.

I was suffering alot by mentally because of the cifas marker and by the great help from cifas marker removal everything was sort out nicely and I back with my bank.. thank you so much.

AK | Monzo Cifas Marker Review

About CIFAS Removal UK

We know how important this is to you. That is why we aim to get you a fair decision as quickly as possible.

Some markers are resolved in just a few days, others can take longer, but in every case we support you until the matter is resolved.

In This Section

Three Ways to Get Started

Many markers are issued unfairly, and our job is to help you challenge them through the Student Loans Company’s complaint process, the Financial Ombudsman, or if needed, the county courts.

Join Our Free Webinar

Every Thursday at 6:00 PM. Learn how to remove a cifas marker, hear real case studies, and ask questions live.

Book Assessment

Get a personalised review of your CIFAS report and a clear action plan. If you proceed, the £100 is used as a credit.

Submit Your Case

Ready to move forward now? Skip the waiting and begin your CIFAS marker removal today.

What is a CIFAS Marker?

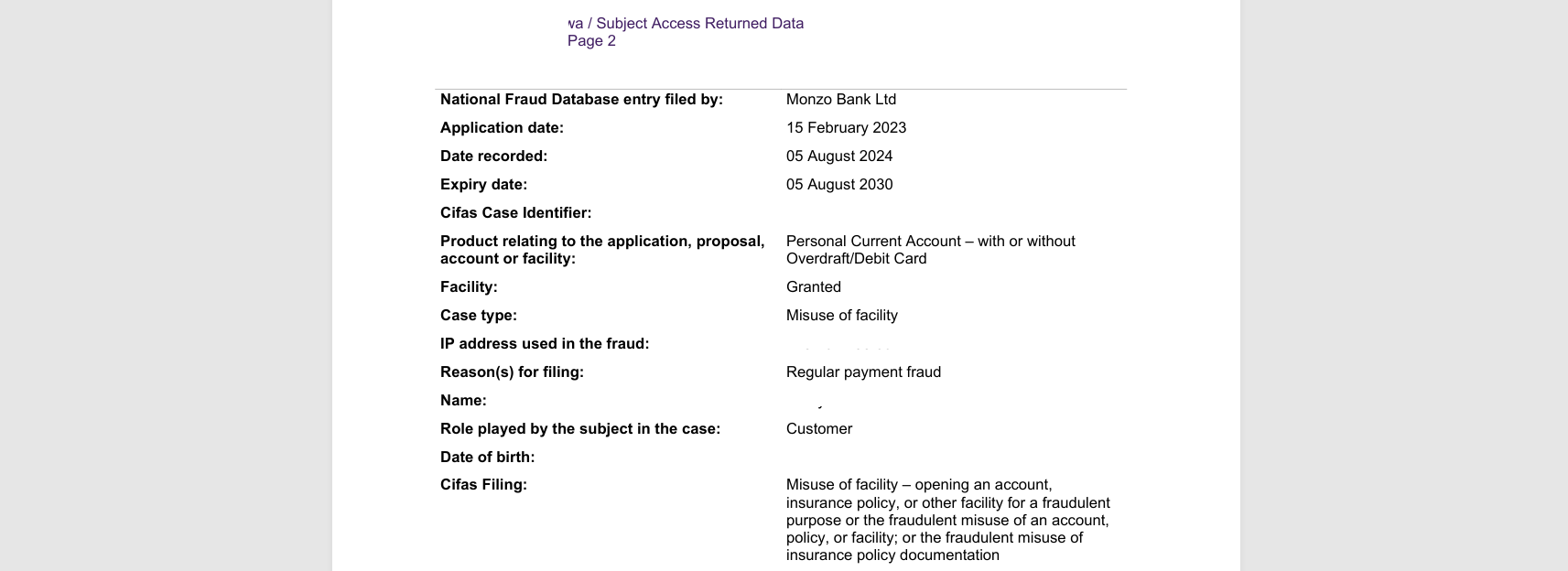

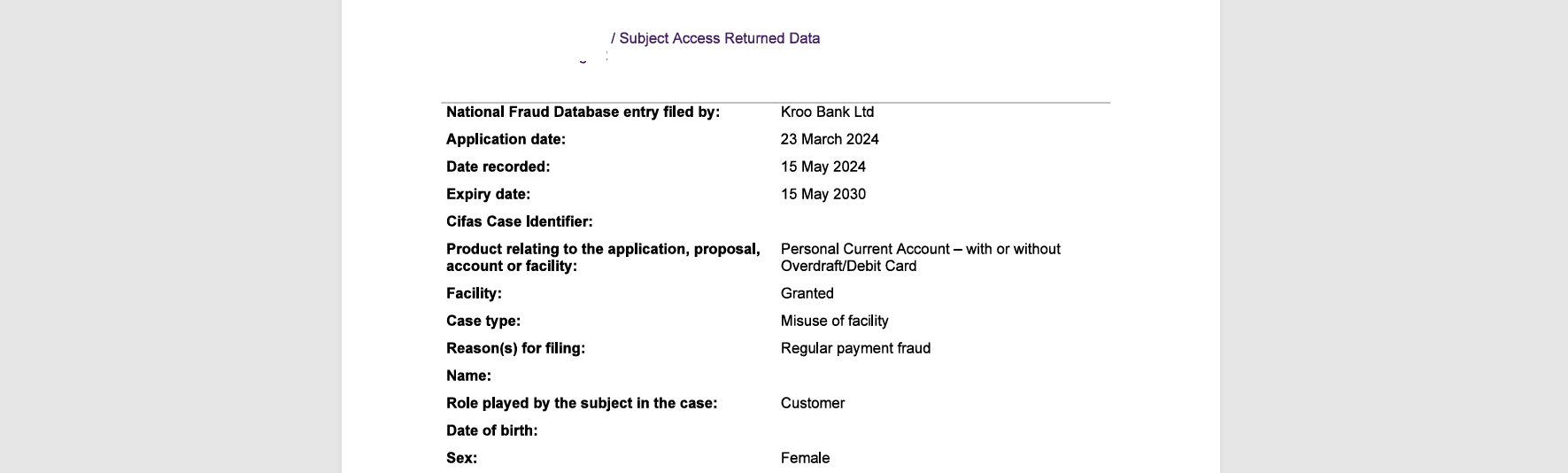

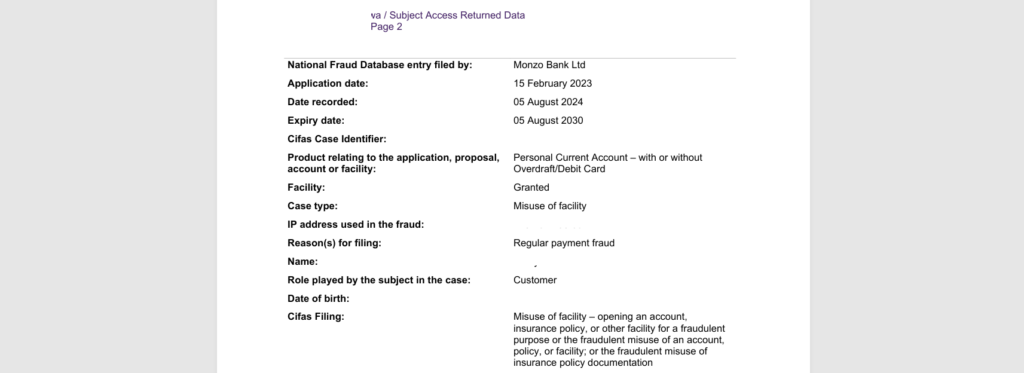

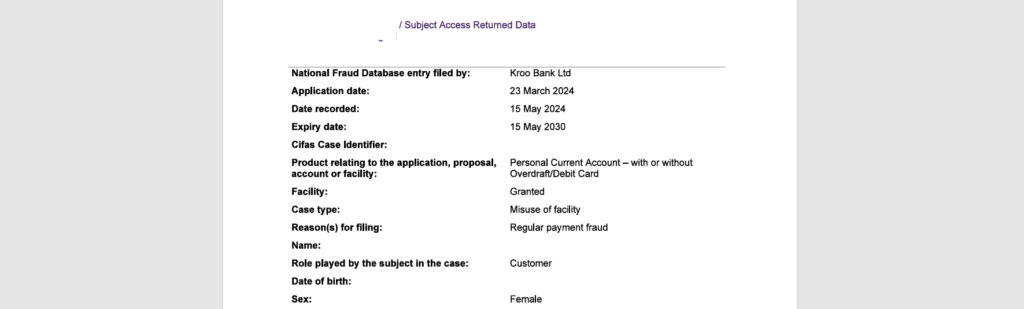

A CIFAS marker is a warning placed on your name in the National Fraud Database. Student Loans Company, lenders, and others share this database to stop fraud.

Once a marker is recorded, it can stay on your file for up to six years unless it is successfully challenged.

Why it causes problems

With a marker in place, you may find that:

- ❌ Bank accounts are closed or new applications are refused.

- ❌ Loans, mortgages, and even phone contracts are declined.

- ❌ Employers who carry out background checks may question your record.

- ❌ Everyday life becomes stressful, you are treated as “high risk” even when you have done nothing wrong.

Why Student Loans Company CIFAS markers are often unfair

Student Loans Company Cifas Markers should only be applied when there is clear evidence of dishonesty, not just suspicion. Unfortunately, Student Loans Company often place them without meeting that standard. This leaves ordinary people unfairly labelled as fraudsters.

💡 The good news: markers can be challenged and removed. With the right approach, you can clear your record and move forward with your financial life.

How We Remove Student Loans Company CIFAS Markers

We focus on one thing, getting unfair CIFAS markers removed. Our process is designed to give you the best chance of success, while keeping things as simple and stress-free as possible.

Step 1: Complaint to the Student Loans Company

We challenge Student Loans Company on why they placed the CIFAS marker. Many cases are resolved here once they are forced to justify their decision.

Step 2: Escalation to the Financial Ombudsman

If Student Loans Company refuses to remove the marker, we take your case to the Financial Ombudsman, an independent body that decides complaints on a fair and reasonable basis.

Step 3: County Court Action (if needed)

For the most complex cases, we help you escalate to the courts. We prepare all the necessary legal documents and arguments, drawing on established case law and decisions made at the highest level.

Some markers are removed in just a few days, while others take a few months. However long it takes, we remain by your side until the matter is resolved.

Why Removing a Student Loans Company CIFAS Marker Matters

Having a Student Loans Company CIFAS marker removed is more than just clearing a database entry, it is about regaining your freedom and peace of mind.

When the Student Loans Company CIFAS marker is gone, you can:

- ✅ Open bank accounts again, no more refusals or unexpected closures.

- ✅ Access credit with confidence, mortgages, loans, and even simple finance become available.

- ✅ Protect your career, many employers check your file, and a clean record removes hidden barriers.

- ✅ Plan your future without fear, no more anxiety every time you apply for something.

For most of our clients, the day their marker is removed feels like a turning point. The stress lifts, opportunities reopen, and life feels normal again.

💡 That is the outcome we work towards in every case, to remove the unfair label and give you back control over your financial future.

Minimum Requirements Before Getting Started

We want to make sure we dedicate our time to people who are serious about clearing their name. That is why we ask every client to meet a few simple requirements before we begin.

1. Case Assessment (£100)

Every case starts here. We review your Student Loans Company CIFAS report, listen to your situation, and outline the best route forward.

If your case is accepted, the £100 is deducted from your chosen package. This way you always know your chances before committing further.

2. Minimum Package (£500)

Our services begin at £500 per marker. We do not offer payment plans, so you will need to be ready to cover the cost upfront.

By setting a minimum, we ensure that both you and us are equally committed to resolving your case.

3. Preparedness

You will need to provide your Student Loans Company CIFAS report and any supporting documents. We guide you on exactly what is needed.

You do not need to figure it out alone, we show you step by step.

👉 Once you are ready, choose how you want to begin:

- 🎓 Join the free Thursday webinar to learn more.

- 🔎 Book your £100 assessment for a personalised plan.

- ⚡ Submit your case for an immediate start.

Our Student Loans Company CIFAS Removal Packages

We offer flexible packages to suit different needs. All packages include the essentials, and you can upgrade at any time if your case becomes more complex or you want extra support.

1. Self Service Complaint – £500 per marker

For people who want to take control of their case with our expert preparation.

- Case review and consultation

- Student Loans Company CIFAS complaint documents drafted for you

- Complaint submission instructions

- All documents prepared within 72 hours

- Email & WhatsApp support

2. Full Complaint Handling – £1,000 per marker

Everything in Self Service, plus:

- Complaint handling and responses prepared for you

- Next day document preparation

- In-person appointments available

- Faster 48-hour response time

- We handle the entire complaint from start to finish

3. Complex & Fast Track – £1,500 per marker

Everything in Full Complaint Handling, plus:

- Priority service

- Accelerated document preparation (24–48h)

- One-to-one meetings available

- Limited to 5 slots per week

4. Court Escalation – £2,500

For cases where complaints and Ombudsman escalation have failed.

Everything in Complex & Fast Track, plus:

- Letter before claim

- Claim documentation

- Review of the Student Loans Company’s defence

- Witness statement preparation

- Hearing preparation and attendance support

Additional £1,000 if you need us or an advocate to attend a hearing.

💡 This package typically costs £8,500+ with a solicitor, our streamlined approach saves you thousands while delivering the same outcome.

Compare Our Packages

| Feature / Service | Self Service (£500) | Full Handling (£1,000) | Complex & Fast Track (£1,500) | Court Escalation (£2,500) |

|---|---|---|---|---|

| Case review & consultation | ✅ | ✅ | ✅ | ✅ |

| CIFAS complaint documents | ✅ | ✅ | ✅ | ✅ |

| Submission instructions | ✅ | ✅ | ✅ | ✅ |

| Email & WhatsApp support | ✅ | ✅ | ✅ | ✅ |

| Documents prepared in 72h | ✅ | ✅ | ✅ | ✅ |

| Complaint handling (done for you) | ❌ | ✅ | ✅ | ✅ |

| Next day document prep | ❌ | ✅ | ✅ | ✅ |

| In-person appointments | ❌ | ✅ | ✅ | ✅ |

| Faster 48h response time | ❌ | ✅ | ✅ | ✅ |

| Priority service | ❌ | ❌ | ✅ | ✅ |

| 24–48h accelerated prep | ❌ | ❌ | ✅ | ✅ |

| One-to-one meetings | ❌ | ❌ | ✅ | ✅ |

| Limited priority slots | ❌ | ❌ | ✅ | ✅ |

| Letter before claim | ❌ | ❌ | ❌ | ✅ |

| Claim documentation | ❌ | ❌ | ❌ | ✅ |

| Defence review | ❌ | ❌ | ❌ | ✅ |

| Witness statement prep | ❌ | ❌ | ❌ | ✅ |

| Hearing prep & attendance support | ❌ | ❌ | ❌ | ✅ (+£1,000 if advocate required) |

What Happens After You Sign Up

We keep everything clear and stress-free. Here’s what happens once you take the first step:

1. Book your £100 assessment

We review your Student Loans Company CIFAS report, listen to your situation, and give you a tailored action plan.

2. Choose your package

Pick the level of support that suits you best, self-service, full handling, fast-track, or court escalation. Remember, you can upgrade at any time if your case changes.

3. We get to work

We prepare your complaint documents, submit challenges, track deadlines, and keep you updated. You will never be left chasing Student Loans Company or wondering what’s next.

4. Resolution

Our goal is always the same, to remove the marker as quickly as possible. Some cases are resolved in days, others in a few months, but we stay with you until it is done.

You are never alone in this process. We guide, support, and update you every step of the way.

Student Loans Company CIFAS Marker Removal FAQ

How long does it take to remove a CIFAS marker?

The time it takes depends on how strong your case is and how Student Loans Company responds.

- Some of our fastest removals have been completed in as little as 24 hours when the evidence is clear.

- On the other end of the scale, our longest case took around 8 months because the institution challenged it all the way through the Ombudsman and into court.

During the complaint process, Student Loans Company often “play hard to get”, dragging their feet, delaying responses, and hoping you give up. But once a case reaches court, that tactic works in your favour. If the Student Loans Company fails to comply with court procedures or deadlines, you can obtain a judgment against them.

Whether your case is resolved in a day or several months, we stay by your side until it is fully resolved.

Can you guarantee my marker will be removed?

No service can guarantee removal, and anyone who says otherwise is not being honest with you. The outcome depends on the evidence Student Loans Company has, how they respond, and whether their decision can withstand a proper challenge.

What we do guarantee is:

- We will review your case carefully before taking it on.

- We only accept cases where there is a realistic chance of success.

- We will use every available process, complaint, Ombudsman, or court, to push for the marker’s removal.

- We will keep you informed and supported throughout.

Many markers are issued unfairly and are removed once challenged. Our role is to give you the strongest possible chance of success, and to fight for you until the matter is resolved.

How much does it cost in total?

Every case starts with a £100 assessment. We review your Student Loans Company CIFAS report, explain your chances, and outline the best route forward. If your case is accepted, this £100 is deducted from your chosen package.

Our packages start at £500 per marker and go up depending on the level of support you want:

- Self Service: £500

- Full Handling: £1,000

- Fast Track: £1,500

- Court Escalation: £2,500 (+ £1,000 if you need us or an advocate at a hearing)

We do not currently offer payment plans, so you need to be ready to cover the costs upfront.

You can upgrade to a higher package at any time if your case becomes more complex, you are never locked in. This way you only pay for the support you actually need.

Do I have to deal with the Student Loans Company myself?

No, that is exactly why people come to us. We take the stress of dealing with the Student Loans Company off your shoulders.

- In the Self Service package, we prepare the complaint documents for you and give you clear instructions on how to submit them.

- In all other packages, we handle everything directly, drafting, submitting, and responding to the Student Loans Company on your behalf.

You will not be left chasing Student Loans Company, waiting on hold, or worrying about what to say. We handle the process so you can focus on getting back to normal life.

What if the Student Loans Company refuses to remove the CIFAS marker?

If the Student Loans Company refuses, that is not the end of the road. It is only the first stage.

- We then escalate your case to the Financial Ombudsman, an independent body that decides complaints on a fair and reasonable basis.

- If the Ombudsman does not resolve it, we can take the case further by preparing county court action.

Student Loans Company often hope people will give up after the first rejection. We do not.

Whether it takes one letter or full legal action, we stay with you until every option has been exhausted.

Will I need to attend court?

In most cases, no. The majority of Student Loans Company CIFAS markers are resolved through the complaints process or the Financial Ombudsman, without ever reaching court.

If your case does go to court, you usually will not need to appear in person. We prepare all the documents, manage the deadlines, and if necessary, arrange an advocate to represent you at the hearing.

We also offer a Court Escalation Package, which covers everything from drafting your claim to preparing witness statements and supporting you right through to the hearing. If your case escalates to court, you can upgrade to this package at any time.

Court is a last resort, and even then, Student Loans Company may settle before a hearing takes place. You will never be left to face it alone.

Will anyone else know I have a marker?

No, your Student Loans Company CIFAS marker is not public. It is only visible to banks and Student Loans Company and other companies that are members of the National Fraud Database. Employers may see it if they carry out enhanced checks, but it is never published on your credit file for the general public to see.

All of your information with us is handled in strict confidence. We only use the documents you provide to challenge the Student Loans Company, the Ombudsman, or the court if necessary.

Nobody outside of the financial system needs to know you ever had a marker. Once it is removed, it is as though it was never there.

How often will I get updates on my case?

You will receive a weekly email update every Friday morning.

Each update explains three things in plain English.

- Current status of your case

- The next step we will take

- The due date we are working toward

If anything important happens between updates, we will contact you right away. You can also message us any time for a same day response.